COMCAST (CMCSA)·Q4 2025 Earnings Summary

Comcast Beats EPS on Wireless Strength, Completes Versant Spin-Off

January 29, 2026 · by Fintool AI Agent

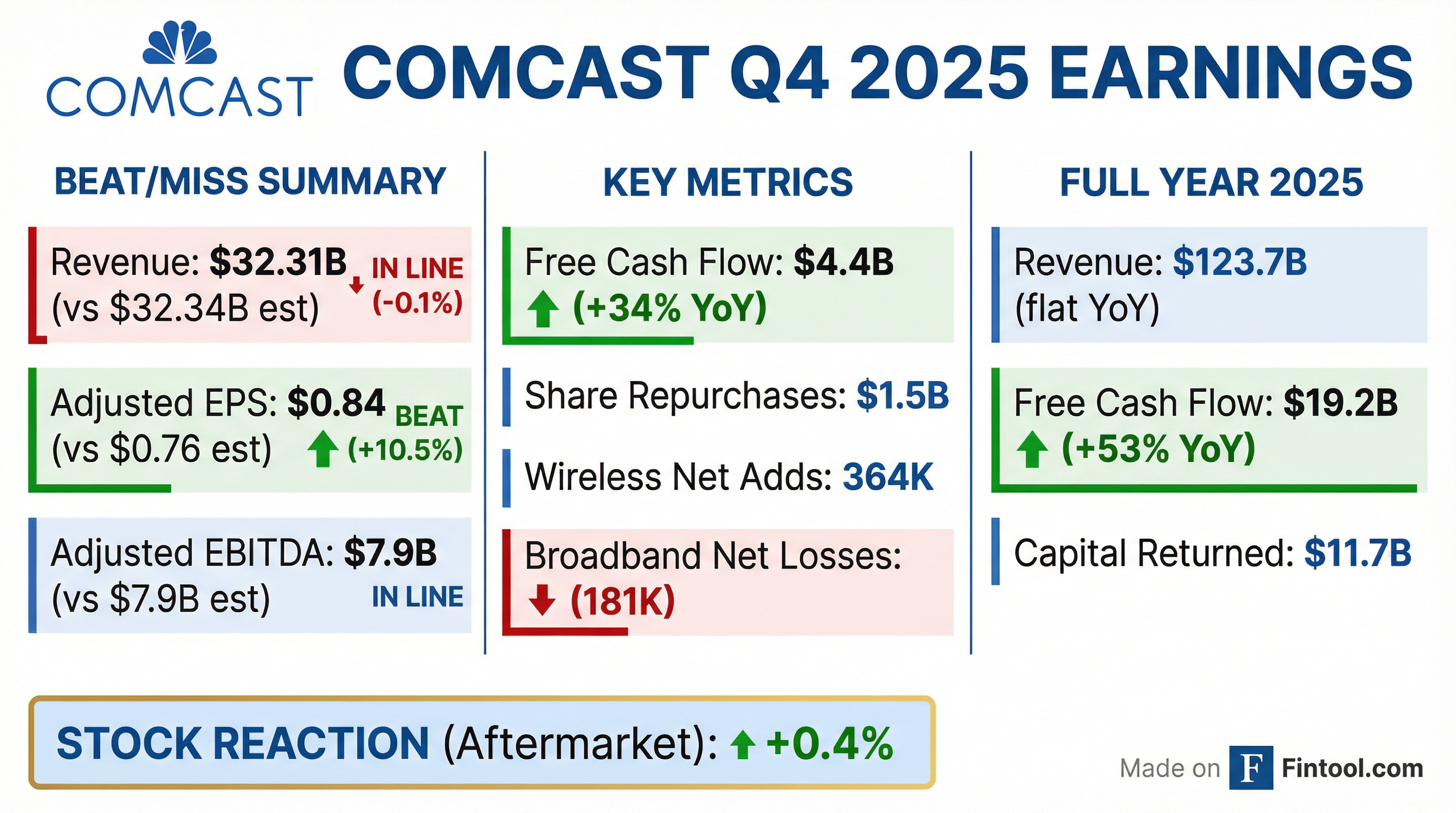

Comcast delivered Q4 2025 results that beat EPS expectations while revenue came in essentially flat versus consensus. The company reported Adjusted EPS of $0.84, beating the $0.76 estimate by 10.5%, though down 12.4% year-over-year due to tough comparisons and investments in growth initiatives. Revenue of $32.31B (+1.2% YoY) matched the $32.34B consensus.

The quarter was defined by strategic execution: completing the tax-free spin-off of Versant Media Group on January 2, 2026, delivering a record year for wireless with 1.5 million net line additions, and generating record free cash flow of $19.2 billion for full-year 2025.

Did Comcast Beat Earnings?

Comcast has now beaten EPS estimates for 8 consecutive quarters, though the magnitude of the beat varied significantly quarter-to-quarter.

The EPS decline versus prior year reflects: (1) a $1.9B income tax benefit in Q4 2024 from an internal corporate reorganization that didn't repeat, (2) transaction costs related to the Versant separation, and (3) investments in the new broadband go-to-market strategy.

What Changed From Last Quarter?

Versant Media Spin-Off Completed: The biggest structural change is the January 2, 2026 completion of the tax-free separation of Versant Media Group, which includes cable TV networks USA, Bravo, MSNBC, CNBC, E!, Syfy, Oxygen, and Golf Channel. Comcast shareholders received 1 share of Versant for every 25 shares of Comcast. This creates a "more focused NBCUniversal centered on streaming, live sports, and premium content."

Broadband Losses Accelerated: Domestic broadband net losses worsened to 181,000 in Q4 2025 from 131,000 in Q4 2024, driven by competitive pressures from fixed wireless. Total domestic broadband customers declined to 31.3 million.

New Go-To-Market Strategy: Comcast launched "the most significant broadband go-to-market shift in our history," featuring four nationwide speed tiers with straightforward all-in pricing, best-in-class gateway, unlimited data, and a 5-year price guarantee. Management noted "encouraging early results" with voluntary churn trending lower, NPS improving, and approximately 40% of the base now on Gig-plus tiers.

Wireless Momentum Continued: Q4 wireless line net additions of 364,000 brought 2025 total to a record 1.5 million, reaching 9.3 million total lines and surpassing 15% penetration of domestic residential broadband customers.

Segment Performance

Connectivity & Platforms

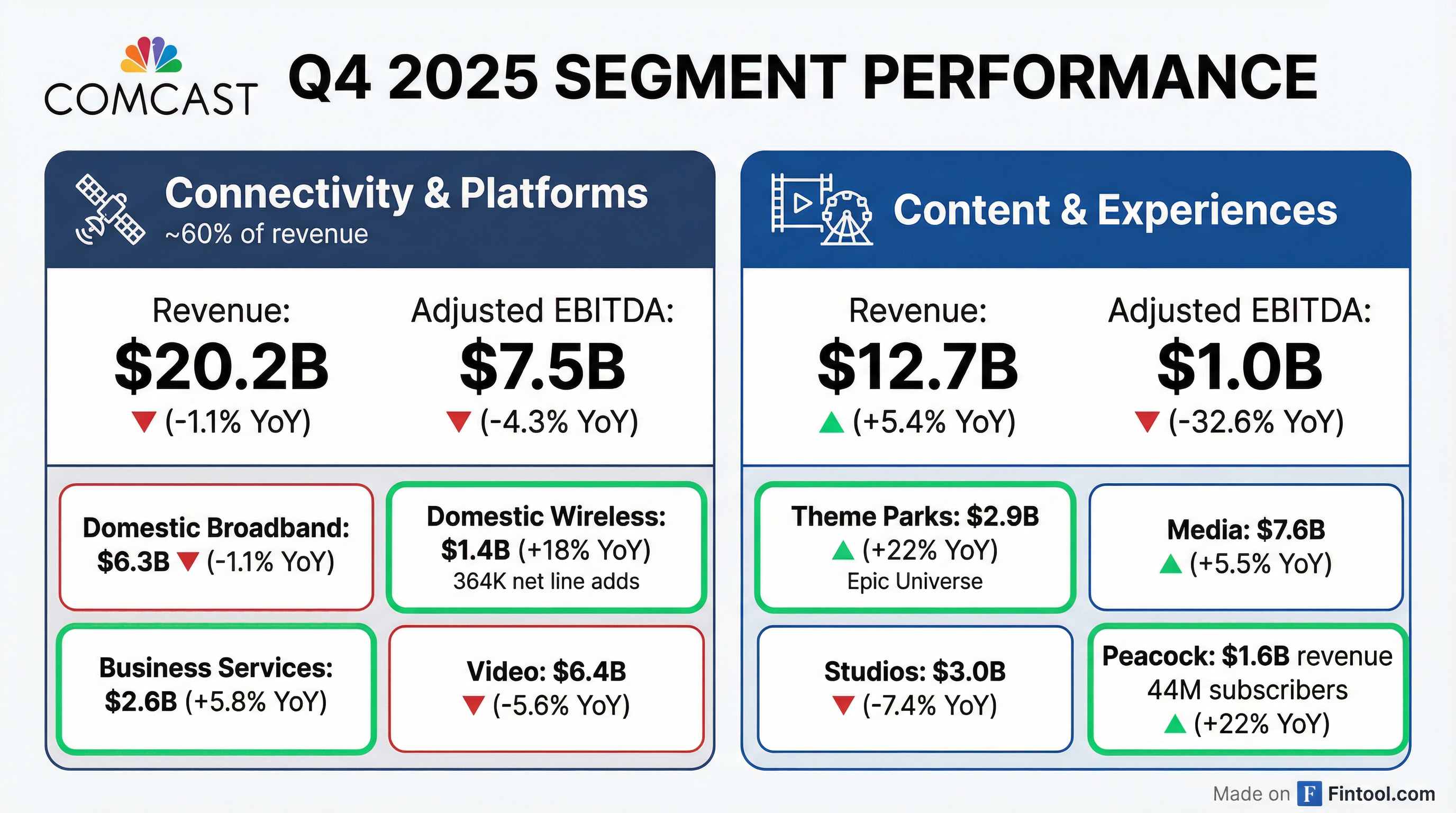

Residential Connectivity & Platforms revenue declined 2.1% to $17.6B, with Adjusted EBITDA margin compressing 140 bps to 34.6%. Key drivers:

- Domestic Broadband: $6.32B (-1.1% YoY) — customer losses offset by higher average rates

- Domestic Wireless: $1.40B (+18.0% YoY) — line growth and higher device sales

- Video: $6.36B (-5.6% YoY) — video cord-cutting continues

Business Services Connectivity was the standout, with revenue growing 5.8% to $2.59B and maintaining a 54.2% EBITDA margin, driven by enterprise solutions including a recent acquisition.

Content & Experiences

Theme Parks delivered the highlight, with Adjusted EBITDA surpassing $1 billion quarterly for the first time, up 24% YoY, driven by Epic Universe opening in May 2025.

Media revenue grew 5.5% to $7.62B, led by Peacock's 23% revenue growth to $1.6B and 44 million paid subscribers (+22% YoY). However, Media Adjusted EBITDA swung to a loss of $122M from a gain of $298M in Q4 2024, reflecting higher programming costs including NBA rights that launched this quarter.

Studios revenue declined 7.4% to $3.03B on tougher theatrical comparisons (Wicked and Wild Robot in Q4 2024 vs Wicked: For Good and Black Phone 2 in Q4 2025).

Capital Allocation

Comcast returned $11.7B to shareholders in full-year 2025, including $6.8B in share repurchases (reducing shares outstanding by 5%) and $4.9B in dividends.

Free cash flow generation was exceptional at $19.2B for full-year 2025, up 53.4% YoY, supported by a $2.0B cash tax benefit related to the 2024 internal corporate reorganization.

2026 Capital Outlook: Total capital spending expected to be "relatively similar to 2025" at roughly $14.4B, with spending at both Connectivity & Platforms and Content & Experiences remaining relatively consistent YoY. Net leverage ended at 2.3x and will increase slightly post-Versant spin, with management intending to migrate back to 2.3x.

Dividend: Annual dividend maintained at $1.32/share. With Versant dividend-in-kind distribution, management noted "investors should see higher total dividends in 2026, marking our 18th consecutive year of dividend growth."

How Did the Stock React?

Comcast shares closed at $28.41 on January 28, 2026, the day before earnings. In after-hours trading following the release, shares rose modestly to $28.51, up 0.4%.

The stock has traded in a range of $24.13 to $35.60 over the past 52 weeks and currently sits below its 200-day moving average of $29.93, reflecting investor concerns about broadband competition and cord-cutting trends.

Full Year 2025 Summary

Co-CEOs Brian Roberts and Mike Cavanagh characterized 2025 as "a year of meaningful progress as we made decisive changes to position the company for long-term, sustainable growth."

Key Risks and Concerns

-

Accelerating Broadband Losses: Net losses of 181K in Q4 2025 vs 131K in Q4 2024 signals intensifying fixed wireless competition

-

Margin Pressure: Connectivity & Platforms EBITDA margin declined 120 bps YoY as Comcast invests in new pricing strategies

-

Media EBITDA Deterioration: NBA rights costs drove Media segment to a loss, with Peacock still losing $552M in Q4

-

Video Cord-Cutting: Video customers fell by 245K in Q4, with total domestic video customers at 11.3M vs 12.5M a year ago

What Did Management Say?

New Leadership: Steve Croney was introduced as the new CEO of Connectivity and Platforms, making his first appearance on a Comcast earnings call. Brian Roberts noted: "From day one running this business, he's challenged long-held assumptions and moved quickly to reset priorities around actions that will drive growth."

Steve Croney outlined his three core pillars:

- Network: "We offer gig internet and wireless to 65 million homes, the largest converged network in the country"

- Product: "Our Wi-Fi reliability ranks number one in our footprint based on independent open-signal testing"

- Customer Experience: "Our biggest opportunity by far... we must make it easier to do business with us"

Mike Cavanagh on Strategy: "My focus over the last 18 months has really been to make sure the management teams and leaders in all of our businesses are properly focused on dealing with the challenges that some of the legacy businesses within our mix have and not let that take away from the focus of putting resources and energy and ambition behind those parts of the business that have growth opportunities."

Network Progress: Roughly 60% of the footprint has transitioned to mid-split spectrum and a virtualized architecture, delivering "a 20% reduction in trouble calls and a 35% reduction in repair minutes where we've deployed FDX technology."

Verizon/T-Mobile Partnerships: The company "modernized our MVNO partnership with Verizon" and will add "T-Mobile as a network partner for our business customers later in the year."

Q&A Highlights

On Broadband Go-To-Market (Mike Rollins, Citi): Steve Croney highlighted early encouraging signs including year-over-year improvement in voluntary churn, strong adoption of the five-year price guarantee, and "continued mix shift toward our Gig-plus tiers, which is a clear differentiator from fixed wireless and satellite." Approximately 40% of the base is now on Gig-plus tiers.

On Wireless Strategy: Croney emphasized: "Huge opportunity in mobile, 65 million passings... we strongly believe we have the right to compete and win in that marketplace." He noted 90% of Xfinity Mobile traffic is offloaded on their own network, providing structural cost advantages.

On Peacock and Media Strategy (Craig Moffett, MoffettNathanson): Brian Roberts explained that examining the Warner Bros. Discovery deal forced them to "take a good look at what we have." He emphasized Peacock is progressing with "pay-one movies and wonderful shows" plus major sports, and noted: "We came to this late because of our Hulu one-third ownership, which we have been able to monetize."

On Peacock Path to Profitability (Jessica Reif Ehrlich, BofA): Mike Cavanagh detailed multiple levers: a successful $3 price increase last summer that held subscriber growth, strong advertising demand with 170 NBA advertisers (20% new), and affiliate deal renewals between 2025-2028 that will build the revenue stream.

On EBITDA Trajectory (John Hodulik, UBS): Jason Armstrong said: "As we look to the back half of the year... we start to lapse some of the incremental investments we made starting in the second half of 2025, and B, we'll get into monetization of... free wireless lines moving into paying relationships." He expects EBITDA improvement in the back half of 2026.

On Theme Parks (Kutgun Maral, Evercore): Mike Cavanagh expressed confidence: "I think we couldn't be more pleased with Epic... By the end of this coming year, I think we'll be fully ramped up." Orlando hotel ADR is up 20% with occupancy up 3 points. The Kids Park in Frisco, Texas opens later this year, along with Hollywood's first outdoor roller coaster and groundbreaking on the UK resort.

On Competitive Environment (John Hodulik, UBS): Steve Croney acknowledged: "In the fourth quarter, we did see a more competitive environment from fiber, and that remains... the mobile environment got significantly more competitive within the quarter." He emphasized: "We've built the plan assuming the environment stays the same."

Forward Catalysts

- Versant Performance: Post-spin execution of the cable networks business as an independent company

- Epic Universe Ramp: Full year of operations in 2026 should drive Theme Parks growth; new Kids Park in Texas and UK groundbreaking

- Wireless Monetization: Free line conversions to paid relationships expected in H2 2026 — "meaningful tailwind to convergence revenue growth"

- Broadband Go-To-Market: Migrating majority of base to simplified pricing by year-end 2026

- Peacock Profitability Path: Another year of "meaningful EBITDA improvement" expected in 2026

- Multi-Gig Symmetrical: Network upgrades completing across "most of the footprint" enabling marketing of differentiated multi-gig speeds

Data sourced from Comcast's Q4 2025 8-K filing, Q4 2025 earnings call transcript, and S&P Global estimates.